Initial Thoughts on Cipher's Acquisition of ParaPRO's, "Natroba"

Cipher Pharmaceuticals has purchased ParaPRO's scabies and headlice drug, "Natroba", for total consideration of $89.5 million USD.

All figures cited are in USD unless stated otherwise.

Relevant Facts from Press Release

On 29 July 2024, Cipher announced its acquisition of the global product rights to ParaPRO’s, “Natroba”, and its authorised generic, “Spinosad”, a topical treatment for both head lice and scabies.

Natroba carries FDA exclusivity and patent protection in the U.S. until 2033.

Natroba currently has 22.1% of the U.S. anti-parasitic market, while its competitor, permethrin 5%, has approximately 71.4%.

The total price paid for the acquisition was $89.5 million USD, comprised of:

$80 million USD in cash, funded 50/50 with cash on Cipher’s balance sheet and a new credit facility with the National Bank of Canada (“NBC”); and

$9.5 million USD in 1,474,097 issued common shares of Cipher, implying a price per share of approximately $6.44 USD or $8.92 CAD.

Cipher’s credit facility with the NBC was initially for a total of $65 million USD. $25 million USD of the facility remains and “…will be available to provide financing to fuel Cipher's continued future growth plans.” There is also an optional “$25 million USD accordion feature”, providing total remaining funds of up to $50 million USD.

Cipher’s credit facility matures three years from closing and has an optional annual extension clause.

Cipher also acquired ParaPRO’s 50-employee, U.S. based sales and marketing team. The sales team relevantly has a well-established network of physician relationships in the dermatology area.

Cipher intends to directly commercialise Natroba in Canada using its existing Canadian dermatology infrastructure by submitting the product to Health Canada for approval in 2024.

Cipher also intends to out-licence Natroba outside of North America to earn product supply revenues and royalties. “Cipher believes that the North American and global market potential for the product is significant.”

Cipher plans to use the ParaPRO’s commercial footprint north of Indianapolis as its U.S. headquarters to launch unique complementary dermatology products across the United States.

ParaPRO’s founder, Bill Culpepper III, will continue to be actively involved with Cipher as a business partner as its second largest shareholder.

According to Craig Mull, Cipher’s CEO, the acquisition has doubled Cipher’s revenues and earnings.

Observations and Implications

Ostensibly a Good Fit for Cipher’s Business

The acquisition seems to fit very well within Cipher’s existing wheel-house. Cipher’s intended direct commercialisation of Natroba in Canada and the licensing of the rights to sell, market and commercialise Natroba outside of Canada and North America to a commercial partner are entirely consistent with Cipher’s current business activities within its products and licensing segments.

Price Paid Seems Reasonable

Cipher appears to have paid a reasonable multiple of approximately 7 times Natroba’s earnings for the acquisition.

This estimate is based on the following facts:

Craig Mull’s comment in the press release that the acquisition has doubled Cipher’s earnings; and

Cipher’s 2023 TTM operating earnings were USD $12.681 million.

Hence, $89.5 million divided by $12.681 million is approximately 7x. This is a rough estimate only.

Debt Burden Seems Manageable for Cipher

We do not know the interest rate applicable to Cipher’s credit facility with NBC.

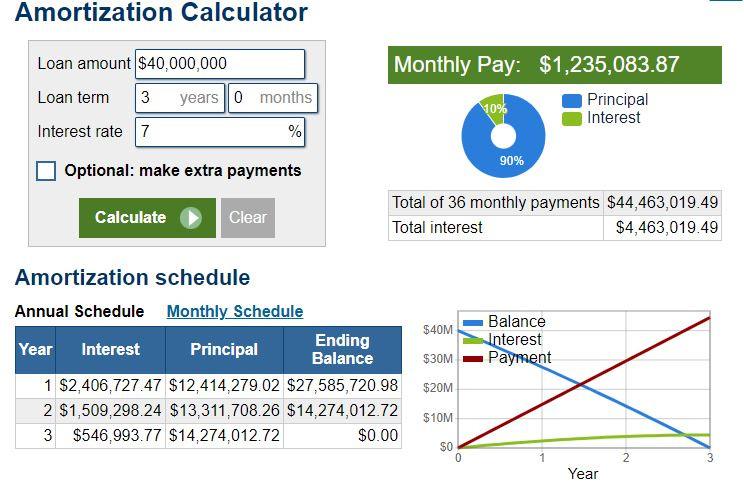

However, if we conservatively assume a 7% interest rate (could be lower) and note that the facility matures in three years, then Cipher’s repayments could look as follows:

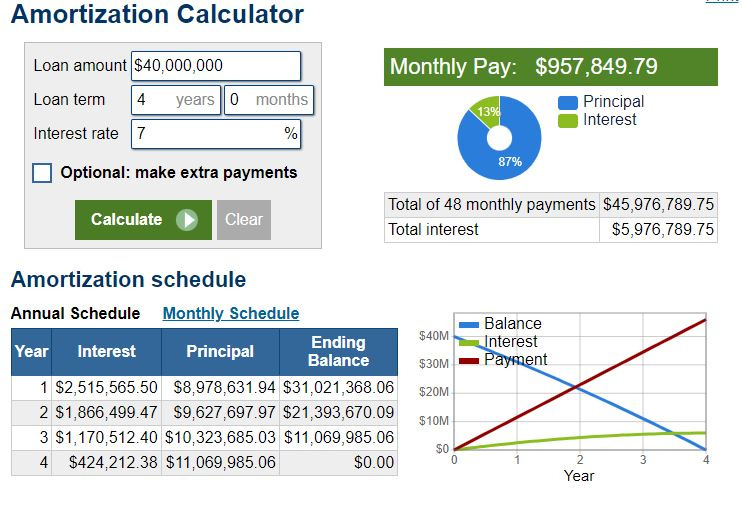

If Cipher were to extend the facility’s term one additional year to a total term of four years, then repayments would look as follows:

Noting that:

Cipher’s 2023 TTM operating income was $12.681 million;

Cipher’s legacy business accumulates excess cash at a rate of $1 million USD per month;

Cipher has approximately $6 million USD of cash remaining on its balance sheet post-acquisition; and

The acquisition has doubled Cipher’s earnings (call it ~$24 million USD),

The abovementioned repayment figures should be manageable for Cipher, notwithstanding that the first principal and interest payment will be ~$14.8 million USD or approximately 61% of Cipher’s operating income this financial year.

Natroba Asset Offers High and Potentially Increasing Returns on Invested Capital

Cipher’s acquisition of Natroba effectively amounts to an incremental reinvestment of capital in the amount of $89.5 million USD. Following repayment of the credit facility, Cipher will earn an approximate pre-tax return on the Natroba asset of 14% (2023 TTM operating income as proxy for Natroba income divided by $89.5 million USD acquisition price), before factoring in any increase in those earnings.

Furthermore, these returns are likely to increase over time without the need for additional reinvestments of capital . Potential sources of increasing Natroba earnings include:

Royalty income from licensing Natroba to a commercial partner for commercialisation outside the U.S. and Canada. For example, Cipher could licence Natroba to Galephar for sale in Latin America (discussed further below).

Increasing market share, sales, and earnings in the U.S. market due to:

The potential ineffectiveness of the market leader, permethrin 5%, arising out of mite drug resistance; and

Increasing awareness of Natroba among prescribers (both discussed further below); and

Increasing sales and earnings from Cipher’s direct commercialisation of Natroba in Canada, sold through a contract sales force.

Importantly, these potential sources of increasing Natroba earnings do not require Cipher to outlay additional capital.

Hence, Cipher’s purchase of the Natroba asset offers both attractive economic returns as things stand, as well as the potential for increasing returns without additional reinvestments of capital on Cipher’s part.

More Acquisitions Potentially on the Way

Cipher’s press release contained a number of indications that there are potentially further acquisitions to come in the future. Specifically:

The press release alludes to further “complementary products” being launched in the US;

Cipher’s CFO, Bryan Jacobs, is quoted as stating that the NBC facility “…provides Cipher with ample liquidity to not only fund the acquisition of Natroba™ and ParaPRO's commercial assets but was designed to provide further financial support to fund future accretive acquisitions as we look to further build out our Canadian and U.S. dermatology platforms."

Cipher has plenty of dry powder left over.

Concerning Cipher’s dry powder, there is approximately $50 million USD remaining of the NBC credit facility and approximately $6 million USD of cash remaining on Cipher’s balance sheeting noting that:

Cipher had $41.981 million USD of cash as at 31 March 2024;

Cipher’s legacy business accumulates cash at a rate of approximately $1 million USD per month according to management. As we are now in August, four months have elapsed since 31 March 2024. Hence, an additional ~$4 million USD has since accumulated on Cipher’s balance sheet, bringing its total at the time of the acquisition to approximately ~$45.981 million USD (call it ~$46 million USD);

Cipher used $40 million USD of its cash for the acquisition. Hence, there should be approximately ~$6 million USD of cash remaining. Furthermore, additional cash will continue to accumulate.

Acquisition of U.S. Based Sales Force is Transformative for Cipher’s Business

Cipher’s acquisition of its own sales force and its intended direct operations in North America are transformative for the business. In a literal sense, it’s transformative because Cipher ordinarily commercialises drugs in North America through the use of a commercial partner and receives royalties and product supply revenues.

However, the acquisition is also transformative in the sense of the opportunities it provides. Now that Cipher has its own U.S. based sales force, it can directly commercialise its portfolio of out-licensed, U.S. drugs and thereby capture a much larger portion of the economic pie, as opposed to receiving only a slither in the form of royalties. This brings me to my next point.

Cipher has the Infrastructure to Bring Absorica In-House

As noted by Left Field and Sebastian Krog on X, now that Cipher has acquired its own U.S. based sales force, the company has the option of ending its commercial relationship with Sun Pharma and selling Absorica in the U.S directly. There is a very strong economic incentive for Cipher to do this given that it will capture a much larger portion of the economic pie by doing so. Furthermore, the time may be ripe to do so, as Cipher’s royalty rate was reduced during the commercial agreement’s renegotiation in March 2022.

Let’s estimate the value of Cipher bringing in-house. Absorica royalty revenues received by Cipher for 2023 were $6.1 million USD. If we assume that Cipher’s royalty rate is 10% (the true rate has not been made public), this provides us with an estimate for Sun Pharma’s Absorica revenues of approximately $60 million USD.

If we further assume that Cipher could earn a 30% operating margin on its direct sales of Absorica (compared to its overall operating margin of 60% for 2023), then Cipher could earn operating income of $18 million USD per annum from its direct sales of Absorica in the U.S. That is a tripling of the royalties it currently receives.

While the numbers serve as a rough estimate only, they illustrate the overarching point: there is significant economic benefit to be gained from bringing Absorica in-house.

Potential for Cipher to Bid for MOB-015 U.S. Licence

As Left Field has pointed out on X, there is now the possibility that Cipher could bid to acquire the rights to commercialise MOB-015 from Moberg in the U.S.

Although Moberg has retained the rights to commercialise MOB-015 in the U.S., its intention, as stated in its Q1 2024 financial report, is to “collaborate with a U.S. partner that has an established sales force targeting dermatologists.”

That is exactly what Cipher has just acquired — a U.S. based sales force that has relationships with dermatologists — and Cipher is already intimately familiar with MOB-015, given that it has already obtained the rights to commercialise the drug in Canada.

So, if ever there were a commercial partner suited to commercialising MOB-015 in the U.S. or collaborating with Moberg in doing so in some way, Cipher is now among them.

Cipher has the Infrastructure to Purchase and Directly Sell Additional U.S. Dermatological Products

On a more basic level, Cipher’s purchase of the U.S. based sales force provides it with the opportunity to acquire additional U.S. dermatological products and commercialise them directly, thereby capturing a larger piece of the economic pie as opposed to merely receiving royalties.

Cipher has a New Operator

Cipher and Craig Mull have effectively partnered with and brought a new operator into the business - ParaPRO’s founder, Bill Culpepper III, who is now the second largest shareholder of Cipher.

This seems significant on the face of it. I can only surmise that Craig Mull would not have diluted himself and brought Mr Culpepper into the operation of his (that is, Craig’s) majority-owned business (recall that Craig is the largest shareholder with ~40%) unless he believed that Mr Culpepper could add significant value. Time will tell.

Natroba is a Highly-Effective Treatment for Scabies

In terms of the effectiveness of the drug, Natroba appears to be a highly effective treatment for scabies and headlice.

In a randomised, double-blind study (helpfully shared by Left Field on X) , Spinosad (Natroba’s authorised generic) achieved a complete cure of 78.1% in only 28 days. This means that 78.1% of the group of patients receiving Spinosad achieved complete cure. “Complete cure” is not defined by the study I have referred to, although it is generally a composite of an objective absence of the treated condition, determined by a test, and a subjective absence of the condition upon a visual inspection of the patient.

Additionally, ParaPRO’s Natroba website notes that the drug achieved a complete cure of 83.9% in the drug’s second phase 3 clinical study. I have not been able to find this study.

The aforementioned study noted that the efficacy of Spinosad is derived from the active ingredient’s ability to reach mites where they feed and reproduce in the stratum corneum (the outermost layer of the skin) without penetrating further. Similarly, ParaPRO’s Natroba website notes that:

“When applied on the outer layer of the epidermis, the active compound (spinosad) is absorbed into the stratum corneum (but not beyond) before sloughing off through the natural process of non-pathologic desquamation (over approximately 14 days).”

Natroba is a Growth Asset With Additional Potential Upside

Culpepper’s Equity Suggests Participation in Upside

Mr Culpepper’s receipt of equity in Cipher potentially indicates that he wants to participate in the additional up-side available in the sale of Natroba.

Obviously, Craig Mull would not have willingly offered equity as part of the deal. Rather, we can surmise based on common sense that Mr Culpepper would have insisted on this himself. Why is that? One potential reason is that he wants to participate in the additional upside in the sale of Natroba. This would also explain his continued involvement in Cipher’s business activities as a business partner.

Furthermore, Mr Culpepper is quoted in the press release explicitly referring to growth opportunities for Natroba:"We believe Cipher is an exemplary partner to support and further expand the Natroba™ product line in the U.S. and globally and will provide growth opportunities to the U.S. based sales and marketing teams.”

However, the counterpoint to this argument is that Mr Culpepper may simply wish to participate in the additional potential upside provided by Cipher’s business and its business plans moving forward, irrespective of Natroba. For example, its commercialisation of MOB-015.

Natroba Could Take Market Share in the U.S. Due to Mite Resistance to Permethrin 5%

Natroba’s main competitor in the U.S. market, permethrin 5%, which has a current market share of 71.4%, is potentially ineffective due to the mites that cause scabies becoming resistant to the drug.

There is growing anecdotal evidence of this. For example, In 1994, mites were killed within 1 hour of in vitro exposure to the drug. In the year 2000, 35% of mites from the same population remained alive after 3 hours. There are no publications confirming clinical resistance in humans, although there is a confirmed case of resistance in dogs.

Furthermore, a separate journal article relevantly notes:

“Nevertheless, multiple in vivo and in vitro studies confirm a significant extension of mite survival of clinical resistance with currently available acaricides, in particular permethrin and ivermectin. In Europe, recent data also suggest a decreasing efficacy of permethrin, with a cure rate of 29% at follow-up with standard regimen.”

If permethrin 5%’s effectiveness is reduced due to mite resistance to the drug, then this provides Natroba with the opportunity to take a portion of permethrin’s significant market share in the U.S., especially in light of Natroba’s excellent complete cure rate of 78.1%.

Natroba Could Increase its Market Share in the U.S. as Prescriber Awareness of the Drug Increases

Another factor which could allow Natroba to increase its market share in the U.S. is increasing prescriber awareness of Natroba as an effective treatment for scabies (Natroba is a prescription drug).

For example, an article in the Journal of the American Academy of Dermatology discussing Spinosad, published in 2021, relevantly noted that:

Spinosad had not previously been evaluated in scabies; and

Spinosad “represents a new treatment option for physicians and patients who otherwise have few approved choices”.

Furthermore, there is no mention of Natroba/Spinosad as a treatment option for scabies on the WHO website or in a journal article dated 2022 discussing the worldwide incidence of scabies (though there is mention of permethrin 5%).

Prescriber unawareness of Spinosad could be explained by the fact that the drug was initially approved by the FDA in 2011 as a treatment for headlice and received FDA approval as a treatment for scabies fairly recently in 2021.

Natroba Could Capture Significant Market Share in Canada due to Mite Resistance to Permethrin 5%

The Canadian market offers a similar potential opportunity for Natroba to capture significant market share as in the U.S. because Permethrin 5% is the current first-line treatment for scabies in Canada. There are, however, alternative treatment options in the Canadian market. A table outlining the scabies treatment options available in Canada is available here.

Scabies’ Large TAM, High Incidence Rate, and High Recurrence Rate Provide the Opportunity for High and Recurring Sales

Scabies affects a large number of people globally. The high global prevalence of the condition provides the opportunity for a leading treatment to potentially capture a large amount of total unit sales.

According to the WHO, scabies is estimated to affect more than 200 million people at any time and more than 400 million people every year globally. Scabies’ prevalence rate varies widely, from 0.2% to 71%. The condition is more prevalent in the Pacific region and Latin America and occurs more commonly in the developing world, tropical climates, and in areas with a lack of access to water.

Furthermore, scabies has a relatively high incidence rate (the rate of new cases as a proportion of total cases) and recurrence rate (the rate of cured patients who contract the condition again). Scabies had an average incidence rate of 5.9%, based on data from 2004 to 2018, available here; and an average recurrence rate of 36%, based on data from 2004-2018, available here.

The significance of scabies’ high incidence and recurrence rates are that they provide the opportunity for recurring unit sales due to new patients contracting the condition (incidence) and former patients re-contracting the condition following treatment (recurrence).

Cipher can Licence Natroba outside the U.S. and Canada to Earn High-Margin Royalty Income

Cipher’s acquisition of Natroba importantly included the global rights for the drug. This means that Cipher has the option of licensing the right to commercialise Natroba outside of Canada and North America to commercial partners, thereby generating high-margin royalty income.

For example, scabies has a high prevalence in Latin America, which is a geography where Cipher has experience out-licensing a product to a commercial partner. For example, Cipher licenses Absorica to Galephar Pharmaceutical Research Inc for sale in Mexico.

Natroba’s Patent Protection Period is Potentially Untapped Outside the U.S.

Natroba’s patent protection in the U.S. will expire in 2033. However, if a patent for the drug has not been registered in other jurisdictions, then Cipher may have the opportunity to register a patent and commercialise Natroba outside of the U.S. for the full, standard 20 year patent protection period.

Concluding Thoughts

At first glance, Cipher’s purchase of the global rights to Natroba appears to be a very promising acquisition.

The all-up consideration of $89.5 million USD paid by Cipher for the drug appears reasonable on the assumption that, as things stand, the drug will earn operating income from sales in the U.S. of approximately $12.681 million USD per annum. This equates to an approximate earnings multiple of 7x and provides an attractive economic return of approximately 14%.

The $40 million USD debt burden assumed by Cipher for the acquisition appears manageable for Cipher, conservatively assuming a 7% interest rate and a maturity of three years. However, Cipher also has the option of extending the facility’s term by 1 year at a time, which provides further margin of safety.

In addition to providing attractive economic returns of approximately 14% post-debt repayment, Natroba also offers the potential for increasing returns on Cipher’s invested capital from a variety of sources, including: first, Cipher’s out-licensing of the Natroba to a commercial partner for sale outside of the U.S. and Canada; second, the potential for Natroba to increase its market share in the U.S. market due to mite resistance to permethrin 5% and increasing prescriber awareness of Natroba; and third, Cipher’s direct commercialisation of Natroba in Canada.

There is also the potential for Cipher to make additional, value-accretive acquisitions in the future, given that this is alluded to in Cipher’s press release and because Cipher has remaining dry powder of approximately $56 million USD, consisting of $50 million USD remaining in the NBC credit facility and ~$6 million USD of cash on its balance sheet.

Cipher’s acquisition of ParaPRO’s U.S. based sales force is transformative for its business. Acquisition of the sales force will facilitate Cipher’s entry into directly commercialising drugs in the U.S. and provides Cipher with the opportunity to purchase additional drugs in the U.S. market, bring its current, out-licensed U.S. drugs in-house, and thereby capture a larger portion of the economic pie with respect to the commercialisation of these drugs.

Specifically, it is now possible for Cipher to bid for the U.S. rights to commercialise MOB-015 from Moberg and to directly sell Absorica in the U.S. Cipher is now well-suited to commercialise MOB-015 in the U.S. due to its sales force that has relationships with dermatologists and because of its intimate knowledge of the drug, given that it has already purchased the Canadian market rights. Furthermore, if Cipher were to end its commercial relationship with Sun Pharma and sell Absorica itself, it could potentially triple its 2023 TTM Absorica royalties of $6 million USD and earn operating income of $18 million USD, assuming Cipher’s royalty rate is ~10%, Sun Pharma’s Absorica revenues for 2023 TTM were ~$60 million USD, and an operating margin of 30%.

Cipher has brought a new operator into its business — the founder of ParaPRO, Bill Culpepper III. Mr Culpepper is now Cipher’s second largest shareholder and will continue to be involved in Cipher’s business activities.

In addition to offering attractive economic returns, Natroba is a highly-effective treatment for scabies, with a complete cure rate in the range of 78.1% to 83.9%. Natroba’s efficacy is especially important in light of the fact that its main competitor in both the U.S. and Canadian markets, permethrin 5%, is potentially decreasing in efficacy due to mite resistance to the drug. While there is only anecdotal evidence of this currently, if mite resistance to permethrin 5% continues to develop, then this could provide Natroba with the opportunity to capture significant market share in the U.S. and Canadian markets, given that permethrin 5% is the first-line treatment in both markets and has a dominant market share of 71.4% in the U.S.

Natroba does not currently have approval from Health Canada for the Canadian market and has only recently received FDA approval as a treatment for scabies (initially receiving FDA approval as a headlice treatment in 2011) in the U.S. Natroba could potentially also increase its market share in the U.S. as prescribers become more aware of the drug, as it seems to be relatively unknown currently.

Looking beyond the U.S. and Canada, scabies offers a very large total addressable market, due to the condition affecting between 200 to 400 million people globally, according to the WHO. Furthermore, the condition has a moderate incidence rate of 5.9% and a high recurrence rate of 36%, meaning that there is an opportunity for an effective treatment to capture a high number of total sales as well as recurring sales from new and repeat cases.

Although Natroba’s patent protection will expire in 2033 in the U.S., if a patent for the drug has not been registered in other jurisdictions, then Cipher may have the opportunity to register new patents and thereby commercialise the drug in jurisdictions outside the U.S. for the full, standard patent protection period of 20 years.

Overall, the Natroba acquisition looks highly promising at first glance, and as a shareholder of Cipher myself, I look forward to seeing how management develop this asset and the business more broadly in the future.

Useful Resources

Spinosad topical suspension (0.9%): a new topical treatment for scabies

Scabies and therapeutic resistance: Current knowledge and future perspectives

First Documentation of In Vivo and In Vitro Ivermectin Resistance in Sarcoptes scabiei

Great summary. More ways for CPH to win now.

I didn't see if you mentioned it but wouldn't fault you at all if you hadn't- the study shared was confusing to me as vehicle reads as if it worked. But that's because they test everyone in the environment. I don't know if this is standardized for scabies or not.