Estimate of Cipher Pharmaceuticals' Potential Future Operating Income Post-Natroba Acquisition.

Cipher's Natroba acquisition has fundamentally changed the business's future trajectory and its potential future value.

Introduction

Purpose of this Post

In my original write-up of Cipher on 20 May 2024 (available here), my overarching thesis was that Cipher’s legacy business was trading at a fair price and included a free call option on two near-term catalysts. To quote my original piece:

The way that I conceptualise the investment opportunity in Cipher is that for the money you pay today, you receive value in the form of a stable, cash-generative, high margin, high return on invested capital business with no debt, lots of cash that’s increasing at a rapid rate, and an able and honest management that is strongly incentivised to act in your best interests as a shareholder. Along with all that value, you also receive what is effectively a call option on two near term catalysts: a large, impending acquisition in 2024 and the commercialisation of MOB-015 in 2025/2026.

My original post included a valuation of the business, though it did not ascribe any value to what later became the Natroba acquisition, given that there was insufficient information at the time.

However, now that the Natroba acquisition has occurred, there is sufficient to place a value on it. Furthermore, the acquisition itself has also unlocked additional catalysts that were not foreseeable at the time of my original write-up.

Therefore, the purpose of this post is to revise my original valuation of Cipher in light of the Natroba acquisition and the additional catalysts which that acquisition has set in motion.

Qualifying Factors

But first, some qualifying words. There are at least three issues posed by this post.

Firstly, business valuation is an art of estimation rather than a science of precise calculation. The purpose of this “valuation” is to roughly estimate the future earnings potential of Cipher’s sources of operating income. Given that I am essentially trying to predict the future, precision is impossible. Rather, I am simply trying to arrive at a reasonable estimate of what the business might earn in the future using the limited information that I have. To quote Keynes, I would rather be roughly right than precisely wrong.

The reason that I am undertaking this exercise, notwithstanding its imprecision, is that you cannot intelligently take advantage of market prices unless you know the approximate value of what you own. Hence, it’s important to carry out the exercise in spite of its imprecision.

Secondly, useful additional information is likely to be released or discovered after this post is published. As that is the case, my hope is that this post can serve as a useful starting point for other shareholders, which they can update and modify as additional information becomes available.

Thirdly, this post represents my own personal opinions about Cipher’s future value. It is still incumbent on you, the reader, to come to your own conclusions. My hope is that my own thoughts, presented here, will be of assistance to you in reaching your own conclusions. However, they are not a substitute for your own analysis.

I have attached various Excel spreadsheets throughout this post containing my working and estimates. Cells highlighted yellow represent columns/rows with changeable inputs. Cells highlighted blue represent columns/rows containing formulas. I have tried to format these spreadsheets so that you can play around with the inputs/assumptions in case you disagree with the assumptions that I have posited.

Let’s begin.

Overview of Operating Income Sources

Following Cipher’s acquisition of Natroba, there are now the following current and future potential sources of operating income within Cipher’s business:

Cipher’s legacy business;

Direct sales of Absorica in the U.S.;

Direct sales of Natroba in the U.S;

Natroba global royalty income;

Direct sales of Natroba in Canada;

Direct sales of MOB-015 in Canada;

Direct sale of MOB-015 in the U.S.; and

Another acquisition.

I have decided not to attribute any value to Cipher’s potential sale of MOB-015 in the U.S. because it is entirely speculative at this stage. Similarly, although I have estimated the potential value of an additional acquisition, I have not included that source of operating income in my estimate of Cipher’s future operating income because it is impossible to say with any degree of accuracy how big a second acquisition will be or how it will turn out.

Estimation of Operating Income Sources

Cipher’s Legacy Business

For FY2023, Cipher’s legacy business earned operating income of $12.681 million USD. I have assumed that Cipher’s legacy business will grow its operating income at compound annual growth rate of 5.55% to account for potentially increasing sales of Epuris in Canada and Mexico.

I have taken the 5.55% figure from Cipher’s September 2023 regulatory filing relating to its substantial issuer bid. That filing, which I discuss in further detail later, contains management’s estimates of the business’s future earnings and implicitly applied a 5.55% CAGR for the legacy business’s operating income. I believe that rate is appropriate in light of the fact that management’s own estimates of the legacy business’s operating income for FY2023-FY2025 significantly understated its actual operating income in FY2023.

However, as I am anticipating that Cipher will sell Absorica directly in the U.S. from 2027 (discussed in further detail below), the $6.1 million USD of Absorica royalties that Cipher earned in FY2023 needs to be deducted from Cipher’s legacy business operating income. As I discuss next, if Cipher does sell Absorica directly, it will not be able to do so until 2027, after its agreement with Sun Pharma terminates on 31 December 2026. Hence, in my model of Cipher’s future operating income (which I attach as a spreadsheet later on in this post), I have deducted the $6.1 million USD of Absorica royalties from Cipher’s legacy business operating income from 2027 onwards.

Summary of Estimated Legacy Business Operating Income

In summary, I estimate that Cipher’s legacy business will earn operating income of ~$13.384 USD in 2024 at a CAGR of 5.55%, with the ~$6.1 million USD of Absorica royalties being deducted in 2027 onwards.

Direct Sales of Absorica in the U.S.

As I noted in my recent post on the Natroba acquisition:

Absorica royalty revenues received by Cipher for 2023 were $6.1 million USD. If we assume that Cipher’s royalty rate is 10% (the true rate has not been made public), this provides us with an estimate for Sun Pharma’s Absorica revenues of approximately $60 million USD.

If we further assume that Cipher could earn a 30% operating margin on its direct sales of Absorica (compared to its overall operating margin of 60% for 2023), then Cipher could earn operating income of $18 million USD per annum from its direct sales of Absorica in the U.S.

However, I now have reason to believe that the 10% royalty rate which I cited in my earlier post may actually understate Cipher’s true royalty rate. For example, at page 6 of Cipher’s 2021 annual report, management states that Cipher’s royalty rate under its agreement with Sun Pharma was originally “in the mid-teens on net sales”. Additionally, during Cipher’s recent Q2 earnings call, Bryan Jacobs, Cipher’s CFO, stated that a 15% royalty rate is “very common” and a good “middle of the road benchmark” for Cipher’s future royalty rate for licensing of Natroba. Hence, I now believe that 15% is a more accurate estimate of Cipher’s royalty rate for Absorica under its agreement with Sun Pharma.

However, Cipher’s royalty rate under the Sun Pharma agreement was reduced during its renegotiation in March 2022. For that reason, I will estimate and assume that Cipher’s royalty rate under the Sun Pharma agreement was originally 15% but has now been reduced to 12.5%.

Applying this revised estimated royalty rate of 12.5% to estimate Sun Pharma’s Absorica revenues produces a figure of $48 million USD, as opposed to the $60 million USD that I cited in my earlier post.

Assuming an operating income margin of 30% on the estimated $48 million USD of Absorica revenues, I estimate that Cipher’s direct sale of Absorica in the U.S. could produce annual operating income of approximately $14.4 million USD, as opposed to $18 million USD.

Sun Pharma currently has the exclusive right to market, sell and distribute Absorica in the U.S. until 31 December 2026, meaning that this source of additional operating income may not become available until some time in 2027.

Summary of Estimated Absorica U.S. Operating Income

In summary, I estimate that Cipher’s direct sales of Absorica in the U.S. could produce additional operating income of $14.4 million USD per annum from 2027, assuming approximate sales revenues of $48 million USD per annum and a 30% operating income margin.

Direct Sales of Natroba in U.S.

Growing U.S. Market Share is a Priority for Management

In Cipher’s recent Q2 2024 earnings call, management relevantly emphasized that:

Pursuing permethrin 5%’s 71% market share in the U.S. is a priority for Cipher. It is, in management’s words, “the most profitable segment” and “low-hanging fruit”;

Mite resistance to permethrin 5% is a global issue and management expects that this issue will unlock “significant revenue and value streams” for Natroba;

Natroba is the only scabies treatment in the U.S. market with a complete cure;

Management believes that Natroba’s sales volumes in the U.S. will be significant;

ParaPro’s management also believe in the growth profile of Natroba and that is why Culpepper opted to receive $9.5 million in Cipher’s shares as part of the consideration paid for Natroba.

So, growing Natroba’s market share in the U.S. is a priority for management and is something they believe is achievable due to Natroba’s superior efficacy in comparison to permethrin 5% due to mite resistance.

Possible Reasons for Increasing Market Share - Superior Efficacy and Growing Awareness

There are two compelling reasons why Natroba should be able to increase its market share in the U.S.

Firstly, as Framp Files highlighted in his recent write-up (available here), Natroba is now a vastly more effective treatment option in comparison to permethrin 5% due to mite resistance. Permethrin 5%’s cure rate has been significantly reduced to around 29% due to mite resistance, whereas Natroba’s complete cure rate is between 78.1% and 83.9%.

Secondly, Natroba is a relatively lesser known treatment option, meaning there is room for Natroba to increase its market share simply from prescribers and patients becoming aware of it. This point was also emphasised by management during the Q2 earnings call; management is focused on educating patients and prescribers that “Natroba is the one product that works”.

Possible reasons for the relative lack of awareness of Natroba among patients and prescribers include Natroba’s fairly recent FDA approval as a scabies treatment in 2021 and, as Framp Files noted, the relative lack of clinical trial data confirming Natroba’s efficacy, as highlighted on the CDC’s website:

This latter issue of being a lesser known treatment option is something that Cipher can potentially directly influence. It’s possible that by utilising its newly acquired U.S. based sales force, which has relationships with dermatologists, Cipher may be able to raise awareness among prescribers, pharmacists and patients of Natroba’s efficacy as a scabies treatment option.

Overall, it seems highly likely that Natroba will be able to increase its market share in the U.S. as a treatment for scabies for the following reasons:

Natroba has only one competing product to overcome — permethrin 5%, which has the vast majority of market share in the U.S.;

Natroba is vastly more effective treatment than permethrin 5%; and

There is room for Natroba to grow its market share simply from increasing awareness of the product.

Furthermore, it may even be possible for Natroba to eventually supplant permethrin 5% as the first-line treatment option and reap the spoils of a dominant market share in the U.S due to its superior efficacy.

Estimation Assumptions

In my estimate of Cipher’s future operating income from direct sales of Natroba in the U.S., I will account for the possibility of Natroba’s increasing market share by making the following assumptions:

Natroba’s 2024 operating income will be roughly equal to Cipher’s 2023 TTM operating income of $12.681 million USD;

Natroba will grow its market share at a rate of 5% per year for 2025-2031 and capture a total market share of 57.10% on the following bases —

Natroba is a far more effective treatment option than permethrin 5%; and

Cipher will likely be able to raise awareness of Natroba among prescribers and patients by disseminating information through its sales force;

Natroba will have an operating income margin of 50%. I have opted for this slightly lower (though still very high) margin to account for the SG&A costs of the newly acquired U.S. sales force;

As a consequence of assumption (3) above, I estimate that at a 50% operating margin, Natroba’s 2024 revenues will be approximately $22.125 million USD;

As a consequence of assumption (4) above, and the fact that management cite Natroba as having a 22.1% market share in the U.S., I estimate that annual sales in the U.S. scabies treatment market equate to approximately $110 million USD. This is a rough estimate only and may in fact understate the true market size; and

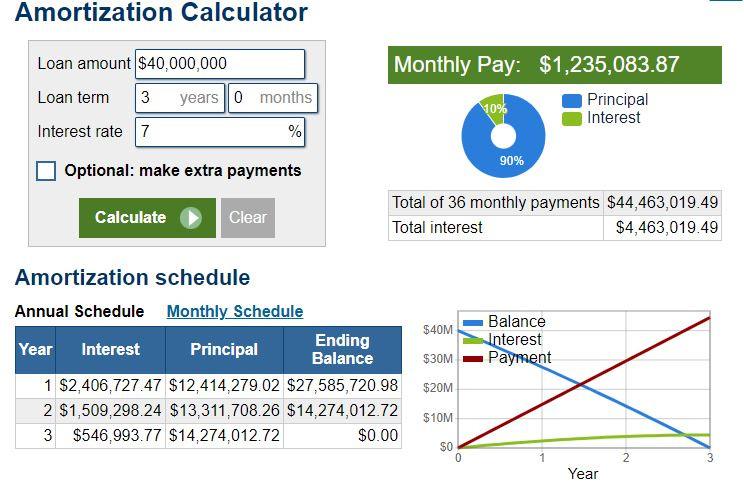

Cipher will repay the $40 million USD of debt which it drew down on the National Bank of Canada facility at an assumed interest rate of 7% over a maturity term of three years, resulting in the following payments beginning in 2024 through to 2026:

Summary of Estimated Natroba U.S. Operating Income

Based on the foregoing assumptions, I estimate that Cipher’s operating income from sales of Natroba in the U.S. could look as follows for the FY2024-FY2031 period:

Direct Sales of MOB-015 in Canada

Management’s Estimates in September 2023 SIB Filing

Placing a value on Cipher’s future sale of MOB-015 in Canada is greatly assisted by the estimates of sales and operating income that management presented in its substantial issuer bid regulatory filing of 6 September 2023. The relevant excerpt of the filing is reproduced below:

The following points of the excerpt are noteworthy:

The figures do not include any revenues or operating income from CF-101 (Piclidenoson) on the basis that it is unlikely to be commercialised in the FY2023 to FY2027 period;

The estimates assume that MOB-015 is commercialised in 2026. This means that the revenue and operating income estimate figures for 2023 to 2025 are solely attributable to Cipher’s legacy business; and

Management assumes that MOB-015 will gain a 90% market share five years after its commercialisation in 2026 - i.e., in 2031.

Disaggregation of Management’s Consolidated Estimates

Management’s estimates of the legacy business’s revenues and operating income for the FY2023 to FY2025 period imply a compound annual growth rate of 3.4% and 5.55% for revenues and operating income, respectively.

FY2026 is the first year that includes management’s estimates of revenues and operating income contributed by MOB-015. However, the contributions of revenues and operating income from MOB-015 and Cipher’s legacy business, respectively, are not disaggregated in management’s estimates for FY2026-FY2027. Rather, consolidated estimates are presented.

Nevertheless, by assuming that the FY2023 to FY2025 legacy business revenue and operating CAGR implicitly assumed by management is also applied to FY2026-FY2027, we can roughly estimate the contributions of revenues and operating income provided by the legacy business and MOB-015, respectively. This is achieved by calculated the estimated FY2025 legacy business revenue and operating income by applying management’s CAGRs to the FY2024 figures, and by subtracting the product from the FY2026-FY2027 consolidated estimates.

Reworking management’s figures in the aforementioned way produces the following disaggregated figures:

As appears from the above figures, we can deduce that management is estimating that MOB-015 will contribute —

~$15.9 million USD of revenues and $9.3 million USD of operating income at an operating income margin of 58.29% in 2026; and

~$31.8 million USD of revenues and ~$21.3 million USD of operating income at an operating income margin of 67% in 2027.

Furthermore, it is also possible to deduce management’s estimates of MOB-015’s revenues and operating income for FY2028-FY2031. Recall that in the SIB filing, management is cited as expecting MOB-015 to achieve a market share of 90% five years from commercialisation in 2026 (i.e., 2031). Separately, during Cipher’s Q4 2023 earnings call (transcript available here), management estimated that the annual sales potential of MOB-015 in Canada is equal to $91 million CAD (or ~$65.6 million USD) per year. Importantly, this estimate is based on the current annual sales of the market leading product, Jublia.

Hence, if MOB-015 were able to capture a 90% market share in 2031, this would equate to revenues of approximately ~$59 million USD (i.e., 90% of the estimated $65.6 million USD total annual sales potential). Furthermore, applying the FY2027 estimated MOB-015 operating income margin of 67%, the estimated 2031 revenues equate to operating income of approximately ~$39.5 million USD.

The growth in revenues and operating income from our estimated 2027 figures of $31.8 million USD in revenues and ~$21.3 million USD in operating income to the 2031 figures of ~$59 million USD in revenues and ~$39.5 million USD in operating income equate to a CAGR of 13.1%. This CAGR can be used to backfill the 2028-2030 revenue and operating income figures by applying the CAGR of 13.1% to the FY2027 disaggregated MOB-015 revenues and operating income that we deduced earlier.

In summary (and restating all reworked figures in full), management’s estimated revenues and operating income from sales of MOB-015 in Canada for 2026 to 2031 are as follows:

Reworking Management’s Estimates to Account for Market Growth

However, management’s estimate of the market opportunity for MOB-015 in Canada is understated because it does not make any allowance for MOB-015 expanding the market for onychomycosis treatments in Canada by causing a greater number of patients to seek treatment.

My own view is that MOB-015’s release in Canada may result in an increasing number of patients seeking treatment for onychomycosis, thereby increasing the value of the market in excess of management’s estimate of $91 million CAD in sales per year. I base this view on the following factors:

Firstly, a single product, Jublia, dominates the Canadian market for onychomycosis treatments with a market share of 90%.

Secondly, Jublia is only moderately effective and difficult to use. Its mycological cure rate is 54% (i.e., only 54% of patients receiving the treatment achieve mycological cure) and treatment requires daily application for 48 weeks, which is difficult for patients to comply with.

Thirdly, MOB-015 is a vastly superior treatment option to Jublia because it is more effective and easier to use. MOB-015’s mycological cure rate is 76%. Furthermore, MOB-015’s treatment protocol only requires application two to three times per week for one to six months, and then application of no more than twice per week to prevent reinfection.

Hence, once a more effective, easier to use treatment option becomes available (i.e., MOB-015), more patients may seek treatment, thereby increasing the value of the market.

MOB-015 is currently only available for purchase in Sweden and is sold as an OTC product. If we look to MOB-015’s release in Sweden for guidance as to how it might perform in Canada (though noting MOB-015 will be a prescription product in Canada), we see that one month after starting consumer marketing, MOB-015 achieved a market leading position in terms of both value and units with a 36% market share and grew the total market in Sweden by 52%.

Hence, MOB-015’s superior efficacy, ease of use, and experience in Sweden are all bases on which we can safely assume that MOB-015 will grow the market for onychomycosis treatments in Canada.

Estimation Assumptions for Expanded Market

To factor in the potential for growth in the market, we can rework management’s estimates by —

conservatively assuming growth in the Canadian market of 10% compounded annually from 2026 to 2031 equating to cumulative market growth of 77.16%;

apply the market share implied by management’s estimates of revenues to the revised market size for each year; and

apply management’s estimated operating income margins of 58% in 2026 and 67% in 2027-2031.

Summary of Estimated MOB-015 Canada Operating Income

Reworking management’s figures in the aforementioned manner produces the following figures:

In summary, I estimate that Cipher’s sale of MOB-015 in Canada could produce operating income of —

~$10.2 million USD in 2026;

~$25.8 million USD in 2027;

~$32.1 million USD in 2028;

~$40 million USD in 2029;

~$49.8 million USD in 2030;

~$70.1 million USD in 2031.

Natroba Global Royalties

Potential Licensing Markets

During Cipher’s recent Q2 2024 earnings call, management relevantly emphasized the following points:

“Natroba will be taken global”;

Management are already in discussions to licence Natroba to select European and Asian countries;

Natroba’s FDA approval and data are likely sufficient for market approval in European markets;

Natroba’s biggest opportunities are in warm climates where prevalence is highest — in “Non-G-12 type countries”;

Shareholders can expect to see licensing deals outside the U.S. within the next 12 months;

Natroba licenses will include a royalty rate of around 15% and milestone payments.

On the basis of management’s comments and my own research, markets of potential interest may include:

China and Indonesia, who are among the five countries with the greatest scabies burden globally;

Brazil, because tropical Latin America is one of the world regions with the greatest scabies burden and because Cipher has experience commercialising products in Latin America via commercial partners. For example, Cipher commercialised Tramadol in Brazil and Mexico in 2013 with Tecnofarma; and Epuris in Mexico with Italmex in 2018 (launched in 2023);

The United Kingdom, because the country is currently suffering from an increasing number of scabies cases, as well as a shortage of the first-line treatment option, permethrin 5%.

There are likely to be many other markets that are of potential interest to management, although my impression from the Q2 2024 earnings call is that management is still in the process of identifying markets and determining appropriate pricing for its product. Hence, the markets I have identified and the estimates of royalty income that I present here should be viewed as an incomplete starting point for estimating Natroba global royalty income.

Estimation Assumptions

In many countries, scabies is not a reportable condition and so precise prevalence data is often not available. I have attempted to estimate prevalence in the markets that I have identified using an average scabies prevalence of 5-10% in children. There are approximately:

Additionally, scabies prevalence varies widely between different geographic locations. To account for this, I have conservatively assumed a uniform prevalence of 5% (noting that the markets I have identified are geographies where prevalence is generally high, except for the UK), which provides affected populations of —

14,470,932 children in China;

4,148,081 children in Indonesia;

2,625,636 in Brazil; and

703,767 in the UK.

My other working assumptions include —

Uniform market share capture of 22.1% across these markets, noting that Natroba’s market share in the U.S. is 22.1% according to Cipher’s Natroba acquisition press release, after only having received FDA approval in 2021;

A royalty rate payable to Cipher of 15%;

A unit price that is comparable to the price of permethrin 5% in each market:

$5 USD in China and Brazil (couldn’t find prices for permethrin 5% in those markets);

A uniform incidence rate (that is, the rate of new cases as a percentage of the affected population) of 5.9%, based on data from 2004 to 2018, available here;

A uniform recurrence rate (that is, the rate of reinfection cases as a percentage of the affected population) of 36%, based on data from 2004-2018, available here;

That commercialisation of Natroba in these markets will commence in 2026; and

That peak, non-recurring sales from treatment of the affected populations will occur over the first seven years from Natroba’s assumed commercialisation in 2026.

Notably, the issue of appropriately pricing Natroba in each of its global markets is an issue that Cipher’s management is still investigating. If, as management have indicated, the product will be sold in less-wealthy nations where prevalence is highest, then it’s likely that the price that can be charged for the product in some of those markets will be modest. Hence my assumptions making the price quite modest and comparable to permethrin 5% where information on its price in those markets is available.

Summary of Estimated Natroba Global Royalties Income

Based on the foregoing assumptions, I estimate that these markets could produce annual royalty income of approximately ~$2.15 USD from 2026:

Obviously, Cipher’s royalties will not be as uniform in their amounts as I have calculated them to be.

Direct Sales of Natroba in Canada

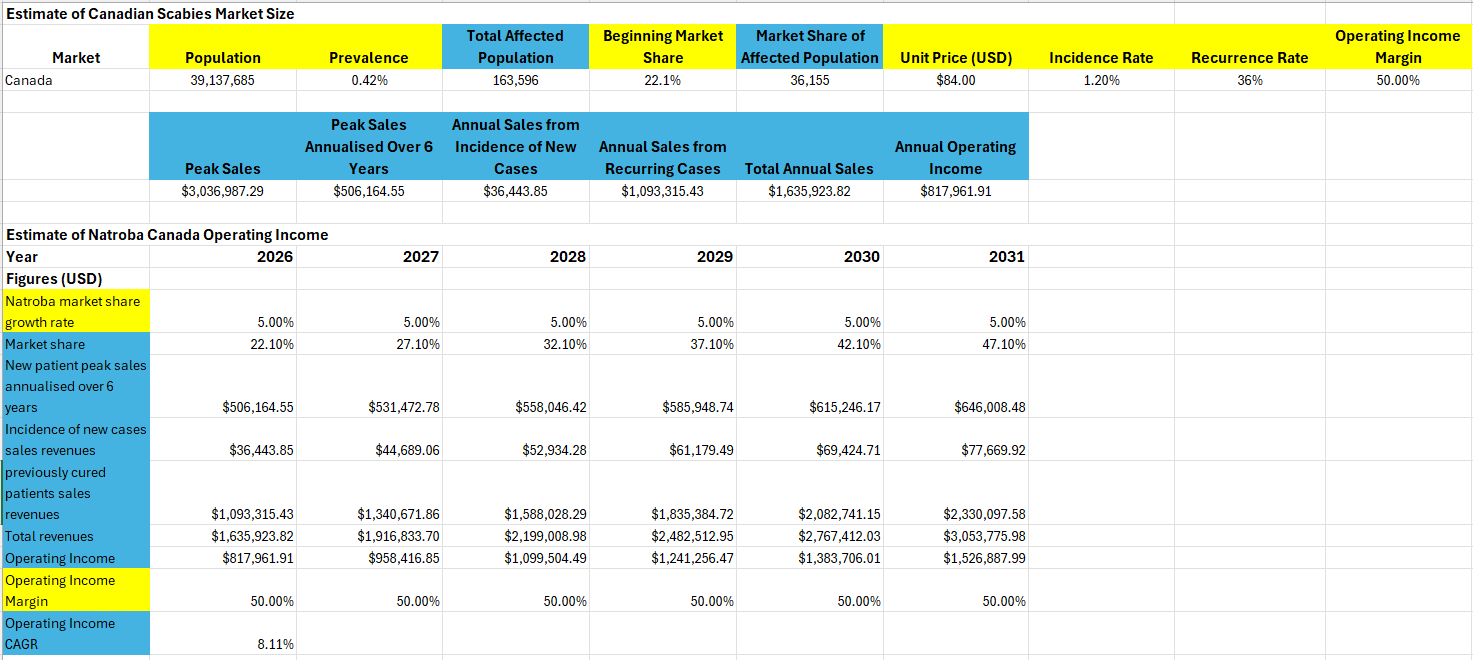

Estimation Assumptions

Fortunately for Canadians, though unfortunately for Cipher shareholders, the prevalence of scabies in Canada seems to be extremely low, at least relative to other markets. This is potentially due to the cold climate in Canada, noting that scabies is most prevalent in hot, tropical climates.

As at 2017, the age-standardized prevalence rate for scabies in Canada was 418 cases per 100,000, or less than 1%. Since the aforementioned prevalence rate is age-standardized, it is not solely applicable to children, unlike the prevalence rates referred to in my assessment of Natroba’s potential global royalties. Assuming that the Canadian prevalence rate cited for 2017 is equally applicable today, applying it to Canada’s current population of ~39,137,685 yields an estimated affected population of approximately 163,596.

In order to estimate Natroba’s operating income from sales in Canada, I will make the following assumptions:

Comparable pricing per unit to the U.S. of ~$84 per bottle (this figure may understate the true cost of the product in the U.S.);

An incidence rate of 1242 cases per 100,000 or 1.2%;

a recurrence rate of 36% (this may overstate the true recurrence rate in Canada given its cold climate);

An operating income margin of 50%;

Launch in Canada occurring at the start of 2026, noting that Cipher will be submitting Natroba to Health Canada for approval in 2024; and

Initial market share capture of 22.1% growing at a rate of 5% per year throughout the estimated period, noting that the Canadian market is comparable to the U.S. market in that permethrin 5% is the first-line treatment option.

Summary of Estimated Natroba Canada Operating Income

Based on the foregoing assumptions, I estimate that Cipher’s sale of Natroba/Spinosad in Canada could produce the following operating income for 2026-2031:

Additional Acquisition

Factors Indicating Likelihood of Another Acquisition

As I discussed in my “Initial Thoughts on Cipher's Acquisition of ParaPRO's, "Natroba"“ post, factors indicating the possibility of another acquisition occurring in the near to medium-term include:

Cipher’s Natroba press release alludes to further “complementary products” being launched in the US;

Cipher’s CFO, Bryan Jacobs, is quoted as stating that the NBC facility “…provides Cipher with ample liquidity to not only fund the acquisition of Natroba™ and ParaPRO's commercial assets but was designed to provide further financial support to fund future accretive acquisitions as we look to further build out our Canadian and U.S. dermatology platforms."; and

Total dry powder remaining of $57.984 million USD, including $7.984 USD million in cash on the balance sheet (as indicated by Cipher’s recently released Q2 financial statements, available here) and a total of $50 million USD remaining of the NBC credit facility.

Furthermore, during Cipher’s recent Q2 2024 earnings call, management relevantly stated that management is currently active in discussions to acquire additional products.

So, the aforementioned factors indicate that another acquisition is potentially on the horizon in the near-term.

Cipher’s Rate of Cash Accumulation

A factor that is important in considering the size of any potential near-term acquisition is the rate at which Cipher’s business accumulates cash on its balance.

Recall that in my original write-up of Cipher, I highlighted the fact that Cipher’s legacy business accumulates cash at the rate of approximately $1 million USD per month, as indicated by the following graph:

However, given that Cipher has effectively doubled its earnings via the Natroba acquisition, the rate at which Cipher now accumulates cash is likely much higher than it was previously, prior to the Natroba acquisition.

We can attempt to estimate the rate at which Cipher’s business will generate excess cash on its balance sheet factoring in the new sources of operating income from FY2024 by looking to the business’s metrics in FY2023.

I have opted to use Cipher’s future estimated operating income as a proxy for the business’s rate of cash accumulation for the following reasons:

The difference between Cipher’s FY2023 operating income of $12.681 million USD and its cash generated from operating activities (“CGOA”) of $15.999 million USD is made up of non-cash (though real) expenses, including depreciation and amortization ($1.227 million USD) and share-based compensation ($1.190 million USD), which are deduced from gross profits to calculate operating income, but which are added back into net income to calculate CGOA.

Cipher’s capital expenditures for FY2023 were practically non-existent, consisting of purchases of PPE ($21,000 USD) and payments for intangible assets ($123,000 USD) totaling $144,000 USD, equating to less than 1% of the business’s $15.999 million USD CGOA.

Cipher’s net increase in cash for FY2023 amounted to $10.611 million USD, which was reduced by discretionary allocations of capital to repurchases of common stock under Cipher’s repurchase plan ($876K USD) and substantial issuer bid ($4.683 million USD). Adding those discretionary uses of capital back in, Cipher’s net increase in cash for FY2023 would have amounted to $16.170 million USD.

Hence, Cipher’s operating income is a somewhat understated, though reasonable, proxy for the business’s cash generation, given that the business has almost no capital expenditures and the material difference between the business’s operating income and CGOA figures is made up of non-cash (though real) expenses of D&A and share-based compensation. Furthermore, Cipher continues to utilize deferred tax assets on its balance sheet, which amounted to $21.632 million USD as at 30 June 2024, meaning that the business’s net income figures are not a reliable or consistent reflection of the business’s earnings power and cash accumulation.

Estimate of Cash on Balance Sheet as at Year End 2026

Up to this point of the write-up, I have estimated that Cipher will earn the following amounts of operating income up to year end 2026:

Recall also that as at 30 June 2024, Cipher has approximately $7.984 million USD of cash on its balance sheet following the Natroba acquisition, as per the Q2 financial statements (available here).

Hence, if Cipher earns approximately ~$10.7 million USD of operating income in FY2024, ~$14.211 million USD in FY2025, and ~$30.942 million USD in FY2026, then the excess cash on Cipher’s balance sheet as at the beginning of 2027 could amount to approximately $55.872 million USD.

Acquisition Valuation Assumptions

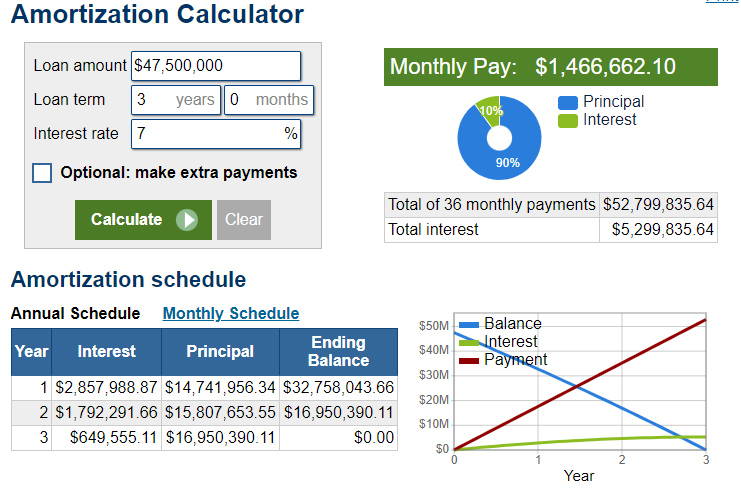

In estimating the potential value of any future acquisition, I will assume that such acquisition will —

Not occur until at least the beginning of 2027 once the funds drawn down on the National Bank of Canada credit facility used in the acquisition of Natroba are repaid during FY2024-FY2026;

Use a mix of debt and equity funding in a 50/50 proportion;

Draw on 85% of Cipher’s estimated $55.872 million USD cash balance at the beginning of 2027 (noting that Cipher used $40 million USD of its total $47.984 million USD cash or ~85% for the Natroba acquisition);

Have a total purchase price of up to ~$95 million USD;

Have similar metrics to the Natroba acquisition. E.g., —

a pre-tax return of 14% on the purchased asset (relative to the price paid) after repayment of any debt used for the acquisition;

Repayment term for any debt used of 3 years at an assumed interest rate of 7% (noting that we do not know the rate of interest on Cipher’s NBC credit facility as of yet), producing the following approximate repayments:

Annual operating income post-debt repayment of approximately $13.3 million USD (i.e., 14% on $95 million USD purchase price).

Summary of Estimated Acquisition Operating Income

Based on the foregoing assumptions, I estimate that a future acquisition could generate additional operating income of approximately $13.3 million USD from 2030 onwards, taking into account debt repayments over the assumed 3 year repayment period from FY2027-FY2030.

Of course, this is all somewhat speculative. Even though it seems likely that an acquisition will occur at some point in the future, it’s impossible to say with any degree of accuracy how big the acquisition will be or how it will turn out. As that is the case, reader’s are wholly justified in deciding to completely ignore this source of potential future operating income in their own assessment of Cipher’s future value. For that reason, I have not included estimated operating income from another acquisition in my calculation of Cipher’s total future operating income.

Capital Returns

Factors Indicating Likelihood of Capital Returns Via Share Repurchases

The discussion in the previous section of Cipher’s significant cash accumulation raises the question: what can we expect will be done with all that cash, outside of acquisitions? If Craig’s capital allocation history is anything to go by, the answer is capital returns via value-accretive repurchases of stock.

There are at least two factors indicating that Craig Mull is likely to return capital to shareholders via share repurchases.

The first factor is a statement that Craig made during Cipher’s Q1 2024 earnings call:

However, in late stages of that process, things took a turn and we decided to move in a different direction. This change of course led us to initiate a substantial issuer bid, which turned out to be a strong use of capital for the business and our shareholders, which brings me to an important point that I want to emphasize. When Cipher is evaluating a transaction or any other material corporate action, the impact of our shareholders will always be a critical consideration to our decision-making.

The significance of the foregoing quote is that it seems to indicate that Craig Mull assesses the attractiveness of a prospective acquisition by reference to share repurchases as the opportunity cost of the transaction. This is indicated by the fact that, once the prospective acquisition that Craig is describing in the quote had fallen through, he immediately pivoted to using Cipher’s capital to repurchase shares.

The second factor indicating that Craig Mull is likely to return capital to shareholders via share repurchases is his recent history of doing so, which I discussed in my initial write-up of Cipher. To avoid repetition, that discussion is available here.

Assumptions For Factoring in Share Repurchases

Hence, given that Craig Mull is likely to return Cipher’s excess cash to shareholders, and given that a reduction in shares outstanding is an important engine for investment returns, I have taken this factor into account in my estimate of Cipher’s future value using the following assumptions:

Returns of capital via share repurchases will commence from 2027 after the debt used in the Natroba acquisition has been repaid; and

20% of Cipher’s operating income will be allocated to share repurchases each year, leaving dry-powder for potential future acquisitions and debt repayments.

To be clear, I don’t expect share repurchases to play out in the uniform manner that I am assuming. I expect repurchases to be far more sporadic and opportunistic, given that their utility is entirely price-sensitive. My objective is simply to take into account capital returns via share buybacks as an additional source of future share price appreciation, much the same as I am trying to do by estimating future operating income.

Putting It All Together

Estimate of Total Operating Income for FY2024-FY2031

In summary, taking into account the multiple potential sources of future operating income within Cipher’s business following the Natroba acquisition, I estimate that Cipher’s operating income could look as follows for the 2024-2031 period:

Implications and Future Valuation

At this point, we have reached the apex of this write-up. The implication of the foregoing estimate of total operating income is that if we simply expand our time horizon out by a few years, we see that the price we pay for Cipher today is peanuts in comparison to the operating income that could be generated by the multitude of catalysts converging in the near future.

In particular, if Cipher’s business were to command an operating income multiple of 15x, then with its significantly increased operating income, its market capitalization and price per share could re-rate as follows:

Concluding Thoughts

An astute investor taking the long view of Cipher’s business with an understanding of the potential earnings catalysts currently brewing within the business has the opportunity to reap the rewards of significant additional upside even after the recent run-up in the business’s price. Overall, the Natroba acquisition has been truly transformative for Cipher’s business, and the convergence of the multitude of earnings catalysts, both pre-existing (MOB-015) and post-dating the Natroba acquisition, will see the business compound capital for its loyal, patient shareholders for years to come.

List of Attached Materials In Order of Appearance

Estimate of Natroba U.S. Operating Income 2024-2031:

Disaggregated Figures for Managment's SIB Estimates - FY2023-FY2027

Estimated MOB-015 Canada Revenues and Operating Income 2026-2031

Estimate of Natroba Global Royalties

Estimate of Natroba Canada Operating Income Canada 2025-2031

Revised Cipher Valuation